Governance

-

- (1)Basic Policy on Corporate Governance

- (2)Corporate Governance Policy

- (3)Corporate Governance Framework

- (4)Board of Directors

- (5)Board of Corporate Auditors

- (6)Members and Attendance Rate of each Board and Committee

- (7)Skill Matrix

- (8)Compensation of Directors and Corporate Auditors

- (9)Independence Requirements for Outside Officers

- (10)Internal Control System

- (11)Actions to Achieve Management with Emphasis on Cost of Capital and Stock Price

- (12)Dialogues with shareholders

- (13)Corporate Governance Report

(1)Basic Policy on Corporate Governance

Solasto’s corporate governance is a mechanism to ensure swift, efficient, fair and transparent management with the aim of continuously increasing corporate value through the realization of our “Corporate Philosophy”. It is to establish and function as a mechanism for such management .

Based on this concept, the governance framework and guidelines were established as the Solasto Corporate Governance Policy at Board of Directors meeting held on June 30, 2016 (Revised on April 1, 2024). By promoting initiatives based on this framework, we aim to continuously improve enhance corporate governance.

(2)Corporate Governance Policy

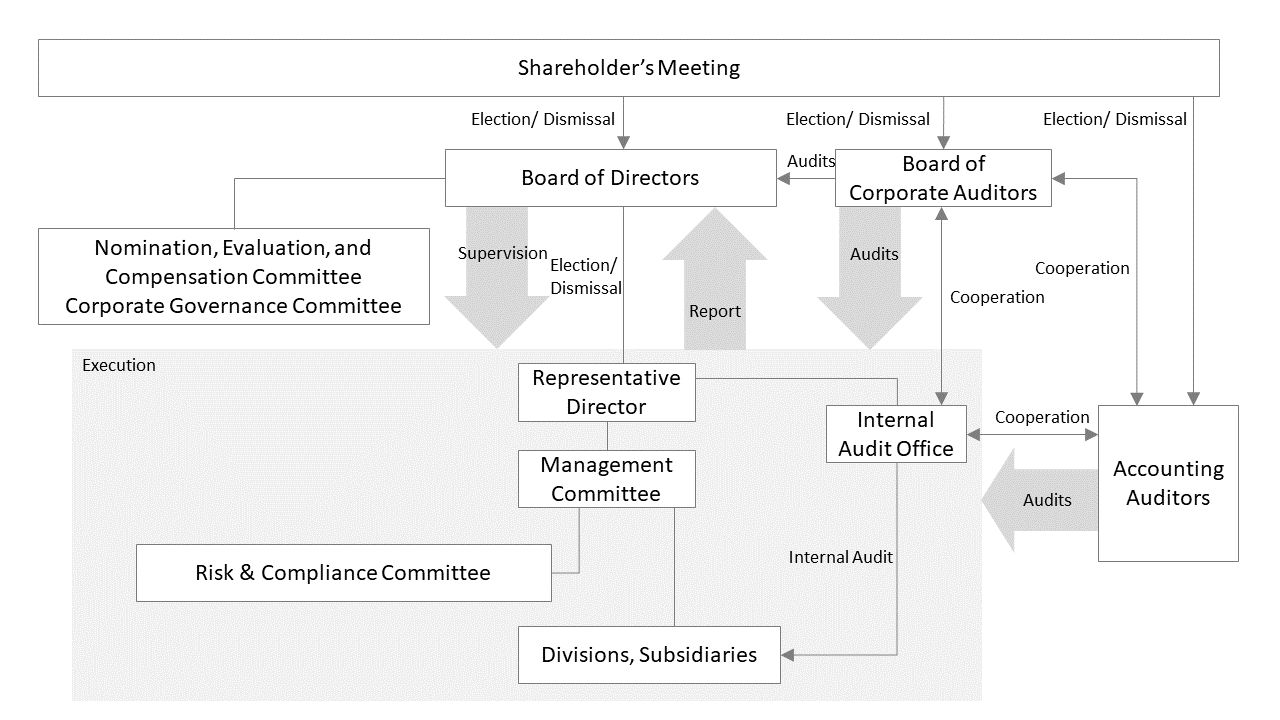

(3)Corporate Governance Framework (As of April 1, 2024)

Solasto selects a company with Board of Corporate Auditors as its institutional design under the Companies Act.

We believe that having more than half of our directors as Outside Directors will strengthen the supervisory function of management, ensure transparency and objectivity in corporate management, and that receiving accurate advice from Outside Directors based on wealth of experience and broad insight enables us to make appropriate decisions.

To supplement the functions of Board of Directors, we established the Nomination, Evaluation, and Compensation Committee and the Corporate Governance Committee under the of Board of Directors, and have established and implemented a system that incorporates the superior aspects of a company with a Nominating Committee, by appointing an Outside Officer as the chairperson, as well as consisting more than half of the members Independent Outside Officers.

Furthermore, we believe that an effective auditing system realized through mutual collaboration among Board of Corporate Auditors, accounting auditors, and the audit department, which is the internal audit department, ensures legality and appropriate audits in a reasonable manner.

Overview of Corporate Governance(As of June 26, 2024)

| Organization Form | Company with Board of Corporate Auditors |

|---|---|

| Corporate Officer System | Yes |

| Maximum Number of Directors Stipulated in Articles of Incorporation | 10 |

| Term of Office Stipulated in Articles of Incorporation | 1 year |

| Chairperson of the Board | President |

| Number of Directors | 6 |

| Appointment of Outside Directors | Appointed |

| Number of Outside Directors | 4 |

| Number of Independent Outside Directors | 3 |

Support System for Outside Directors and Outside Corporate Auditors

General Affairs Division provides support to Outside Directors, and Internal Audit Office and General Affairs Division provide support to Outside Corporate Auditors.

In principle, materials for the Board of Directors are distributed in advance by the Secretariat of the Board of Directors to ensure that Outside Directors and Outside Corporate Auditors have adequate time to consider them. They also provide advance explanations as necessary.

Materials for important meetings are distributed to Outside Directors from the secretariat of the Board of Directors and other bodies. Full-time Corporate Auditor shares information on Corporate Auditors’ audits, accounting audits and internal audits to Outside Corporate Auditors.

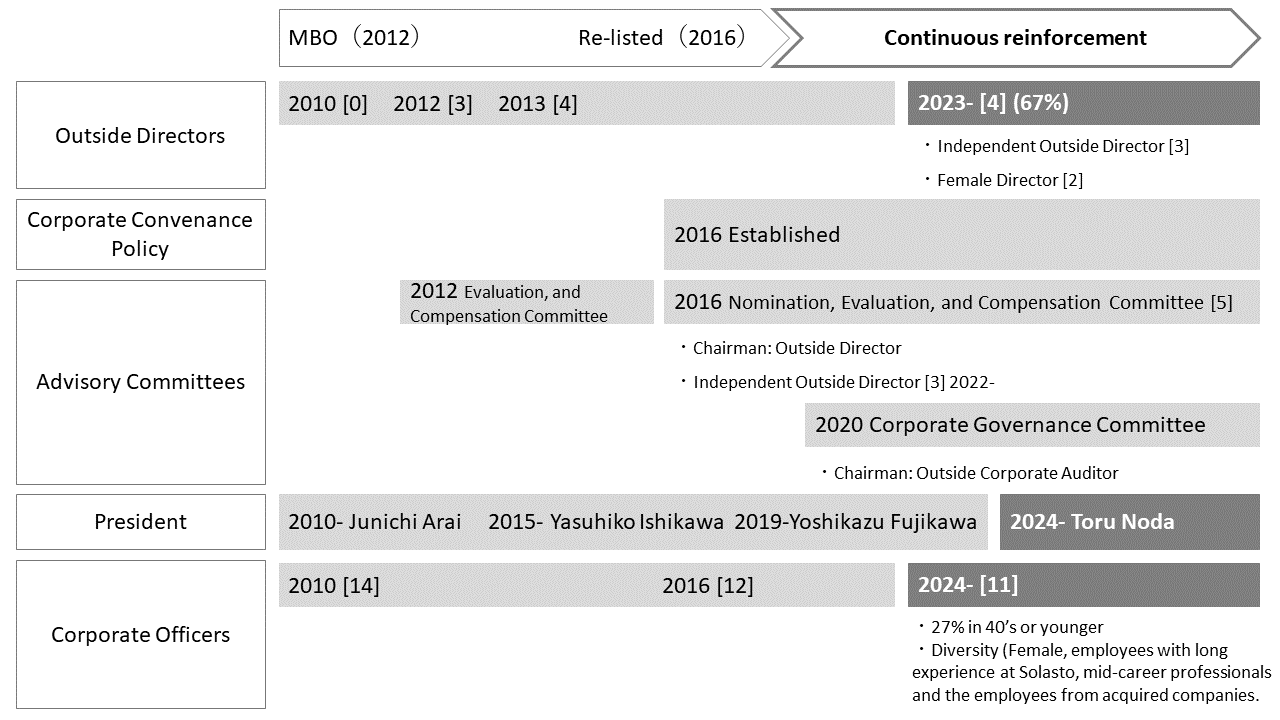

Progress in Strengthening Corporate Governance

(4)Board of Directors

Board of Directors

The Board of Directors consists of six Directors (including four Outside Directors) and is chaired by the President. The Board of Directors aims to realize proactive governance through prompt and decisive decision-making and appropriate risk-taking in order to enhance corporate value over the long term after having established fairness and integrity. In addition to ensuring the effectiveness and transparency of management through the exercise of oversight functions over overall management through decisions on important business execution, the supervision and approval of candidates for Directors and Corporate Auditors and the appointment of corporate officers, and supervision and approval of annual budgets, medium-term management plans, and other important strategies, it also monitors the efforts of corporate officers, including the President, to increase corporate value. In addition, our Board of Directors have a 1-year term of office in order to clarify management responsibilities and enable the Company to respond swiftly to changes in the business environment.

| Name | Position/Significant Concurrent Positions Outside the Company (As of June 26, 2024) |

|---|---|

| Reason for Appointment | |

| Toru Noda |

President and Representative Director, President Corporate Officer Chief Executive Officer General Manager of Management Division Professor of Graduate School of Business Sciences at University of Tsukuba |

| As Representative Director, Mr. Noda has been demonstrating his skills to facilitate our growth and increase corporate value through strong leadership. Solasto judges that he will be able to further enhance its corporate value by utilizing his rich experience and broad knowledge as President, and has appointed him as a Director. | |

| Masateru Kawanishi | Director, Senior Managing Corporate Officer, Chief Transformation Officer General Manager of Transformation Department |

| Drawing on the extensive experience Mr. Kawanishi gained at Japanese and foreign companies, he has demonstrated his outstanding execution skills and led the transformation of a companywide HR process since joining the Company. Currently, as General Manager of the Transformation Promotion Division, he is responsible for transforming business models and promoting innovation. Solasto has decided to appoint him as a Director because he is expected to continue to contribute to the growth of us and enhancement of its corporate value, going forward. | |

| Yukio Kubota | Outside Director Outside Director of KOEI DREAMWORKS Co., Ltd. |

| Mr. Kubota has a wealth of experience and extensive knowledge as the Director including Representative Director among plural companies. Therefore, the Company has appointed him as an Outside Director with expectation that he will use this experience to supervise and support management toward improving our corporate value. | |

| Kenji Chishiki | Outside Director [Independence] Outside Director of Ishii Food CO., Ltd. Director and Vice President of ONWARD HOLDINGS CO., LTD |

| Mr. Chishiki has served as a representative director in a number of companies, as well as has a wealth of experience serving as an outside director. The Company has appointed him as an Outside Director because he has a wide range of knowledge and experience in personnel development, organizational management including corporate culture, and the establishment and strengthening of management foundations, with the expectation he will provide useful advices to the Company. | |

| Miki Mitsunari | Outside Director [Independence] President of FINEV inc Director of Japan Accreditation Board Outside Director of YAMADA HOLDINGS CO., LTD. Outside Director of YUASA TRADING CO.,LTD. |

| Ms. Mitsunari has served as the representative director of a consulting company related to the environment, climate change, ESG, and the SDGs, and has experience serving as an outside director for multiple companies. She also possesses vast knowledge and broad perspective concerning environmental problems related to real estate, disaster prevention measures and risk management. We have appointed her as an Outside Director with the expectation that she will provide beneficial advice as we aim to provide high-quality services based on a fusion of humans and technology. | |

| Miho Tanaka |

Outside Director [Independence] Partner of Shiba & Tanaka Law Offices Supervisory Director of Marimo Regional Revitalization REIT, Inc. Supervisory Director of JINUSHI Private REIT Investment Corporation Outside Director of Tokyo Century Corporation |

| Ms. Tanaka is very familiar with corporate legal affairs and areas related to M&A. In addition, since she has extensive experience and deep knowledge and is expected to provide advice useful to the Company, we have decided to appoint her as an Outside Director. |

Roles and Responsibilities of the Board of Directors and Required Qualifications

The Board of Directors is responsible for making sustainable improvements to corporate value by appropriately executing their roles to fulfill their entrusted duties. As both an individual and as a member of a corporation, a director must possess a high sense of ethics, fairness, and integrity, and engage in actions that represent the common interests of shareholders. Directors much also possess objectivity, observational skills, practical knowledge, and seasoned decision-making skills.

Board Effectiveness Evaluation

The details and results of the evaluation of the effectiveness of the Board of Directors conducted in 2024 are as follows.

Summary of Evaluation of Effectiveness of Board of Directors in 2024(PDF 437KB)

Details and results of past implementation

The Summary of Board Effectiveness Evaluation in 2023(PDF 164KB)

Notice Concerning the Summary of Board Effectiveness Evaluation in 2022(PDF 268KB)

Other Committees

[Nomination, Evaluation, and Compensation Committee]

The Nomination, Evaluation, and Compensation Committee, chaired by an Outside Director, proposes candidates for the President and corporate officers to the Board of Directors. In addition, the Committee assists the Board of Directors in its role in the nomination, evaluation and compensation of management by setting and evaluating annual targets for corporate officers, as well as evaluating and determining whether corporate officers’ remuneration is competitive and appropriate.

[Corporate Governance Committee]

The Corporate Governance Committee, chaired by an Outside Director, assists the Board of Directors in its roles by deliberating on ongoing enhancements to corporate governance and initiatives to increase management transparency and fairness, and proposes them to Board of Directors.

[Management Committee and Other Bodies]

Solasto has established a Management Committee, the purpose of which is to promote rapid and efficient decision-making by the Board of Directors by serving as an entity that deliberates and decides on important matters related to business execution. The Management Committee is comprised by all Corporate Officers including President. In principle, the committee meets twice per month. Also, Corporate Officers’ Meeting, which is comprised by all the Corporate Officers including President, is held at least once per month. Its purpose is to discuss and share the important matters for the business execution. Furthermore, Divisional Strategy Meeting, which is comprised by the President and the Managers of related divisions, is held monthly to report and discuss the progress in strategic measures by divisions and changes in business environment. Through those activities, the Company endeavors to strengthen its structure with improved business execution and further transparency. The Company has also established Risk & Compliance Committee which serves as a general management entity for risk response and compliance for the entire company, and Investment Management Committee which evaluates investment efficiency on investment projects and monitors post-investment.

General Policies and Procedures for Appointing Management Team and Nominating Directors and Corporate Auditors

Solasto selects, regardless of gender, nationality, age, etc., its candidates with the knowledge and experience required to execute the authority and responsibilities deemed required of Corporate Officers and Directors. Candidates are nominated for the position of Corporate Officer and Director by our Nomination, Evaluation, and Compensation Committee and submitted to the Board of Directors for approval. Corporate Officer candidates must be appointed by the Board of Directors. Director candidates are appointed at the General Meeting of Shareholders after the approval of the Board of Directors. Corporate Auditor candidates are subject to consent by the Board of Corporate Auditors and approval by the Board of Directors before candidates can be appointed by the General Meeting of Shareholders.

(5)Board of Corporate Auditors

Board of Corporate Auditors

The Board of Corporate Auditors consists of four Corporate Auditors (including three Outside Corporate Auditors). Solasto has established a system to ensure the effectiveness of audits by each member of Board of Corporate Auditors, and decides the chairperson among the members of Board of Corporate Auditors. Auditors audit the execution of duties by Directors and the fulfillment of the supervisory obligations of the Board of Directors by attending important meetings, including meetings of the Board of Directors. In addition, the Board of Corporate Auditors meets monthly in conjunction with the Board of Directors Meeting to formulate auditing policies and plans, as well as to receive reports from each Corporate Auditors on important auditing matters and discuss or make resolutions.

| Name | Position/Significant Concurrent Positions Outside the Company (As of June 26, 2024) |

|---|---|

| Reason for Appointment | |

| Masami Nishino | Full-time Corporate Auditor |

| Mr. Nishino has many years of experience in internal auditings of Solasto and the group companies. He also has extensive experience and knowledge that contributes to the enhancement and improvement of corporate governance. The Company believes that he can perform the auditing functions necessary for the Company’s management leveraging this experience and knowledge and therefore has appointed him as a Corporate Auditor. | |

| Horonori Yokote | Outside Corporate Auditor [Independence] Head of Hironori Yokote CPA Office Representative Partner of Miogi Audit Corporation Outside Corporate Auditor of Suzuki Shokai K.K. |

| Mr. Yokote has a wealth of knowledge and experience in accounting and taxation as a certified public accountant(CPA) and tax attorney. In addition, he has experience being seconded for many years to the Listing department of the Tokyo Stock Exchange, and he is familiar with the practical business of listed companies. Accordingly, Solasto expects that he will be able to give useful advice to further strengthen the corporate governance of the Company. Therefore, the Company has appointed him as an Outside Corporate Auditor. | |

| Kanae Fukushima |

Outside Corporate Auditor [Independence] Outside Corporate Auditor of iXs Co., Ltd Partner at Utsunomiya Shimizu & Haruki Law Office Outside Director (Audit & Supervisory Committee Member) of World Co., Ltd. |

| We believe that Ms. Fukushima will be able to audit the execution of the duties of Directors from a fair and objective perspective based on the extensive knowledge and experience she gained through the handling of civil, criminal and administrative cases in family courts, district courts and high courts after being appointed a judge. Accordingly, it has decided to appoint her as an Outside Corporate Auditor. | |

| Tsukasa Okamoto |

Outside Corporate Auditor Director, Senior Executive Officer and General Manager of Management Department, CFO of Daito Trust Construction Co., Ltd. |

| As a certified public accountant, Mr. Okamoto not only has a wealth of expertise and experience in corporate accounting, but also a broad knowledge about corporate management through a range of experiences such as serving as a director at a large construction company. We believe that by utilizing his expertise as a certified public accountant, he will be able to audit the execution of the duties of Directors from a fair and objective perspective, and has therefore decided to appoint him as an Outside Corporate Auditor. |

Cooperation among Corporate Auditors, Accounting Auditors, and Internal Audit Departments

Through strengthening mutual cooperation among Corporate Auditors, Accounting Auditors and the Audit Department and exchanging opinions at the regular meetings, Solasto strengthens the quality of audits covering all management activities. The Corporate Auditors Office is in charge of communication and coordination with relevant departments within Solasto in order to accurately provide corporate information to Outside Corporate Auditors.

In regards to the audit by Corporate Auditors, they perform appropriate audits by attending important meetings, visiting divisions, business locations and subsidiaries, exchanging viewns with Directors, and receiving reports on audit planning and results from the Accounting Auditors. The findings of these audits are reported to all divisions through the Board of Directors.

The Company has an audit agreement with KPMG AZSA LLC and undergoes an accounting auditor by the firm.

Under the direction of the President, the Audit Department is responsible for the Solasto’s internal audits, and auditing functions. The department conducts audits of the effectiveness of internal controls and the status of actual execution of operations for each division at the head office, all the business locations, and subsidiaries. The results of these audits are reported to the President and the Board of Directors as well as departments which functions as upper organizations of each division as needed. In addition, Internal Audit Department holds meetings and exchanges views with the Corporate Auditors as necessary.

(6)Members and Attendance Rate of each Board and Committee

◎ Chairperson● Head of Committee○ Member( )FY2023 Attendance rate

| Position | Name | Board of Directors | Board of Corporate Auditors | Nomination, Evaluation, and Compensation Committee | Corporate Governance Committee |

|---|---|---|---|---|---|

| President and Representative Director |

Toru Noda | ◎(100%) | ○ | ○ | |

| Director | Masateru Kawanishi |

○(-) | ○ | ||

| Outside Director | Yukio Kubota | ○(100%) | ● | ○ | |

| Outside Director (Independent) |

Kenji Chishiki | ○(100%) | ○ | ○ | |

| Outside Director (Independent) |

Miki Mitsunari | ○(100%) | ○ | ○ | |

| Outside Director (Independent) |

Miho Tanaka | ○(-) | ○ | ● | |

| Full-time Corporate Auditor |

Masami Nishino | ◎(100%) | ○ | ||

| Outside Corporate Auditor (Independent) |

Hironori Yokote | ○(100%) | ○ | ||

| Corporate Auditor (Independent) |

Kanae Fukushima | ○(-) | ○ | ||

| Outside Corporate Auditor |

Tsukasa Okamoto | ○(-) | |||

| Attendance rate | 100% | 100% | 100% | 100% |

(NOTE) Directors, Mr. Masateru Kawanishi and Ms. Miho Tanakawere appointed as the Company’s Outside Director on June 26, 2024. Corporate Auditors, Ms. Kanae Fukushima and Mr. Tsukasa Okamoto were appointed as the Company’s Outside Corporate Auditor.

(7)Skill Matrix

The expertise and experience of each Director and Corporate Auditor are as follows.

| Name / Position | Gender | Expertise and Experience | |||||||

|---|---|---|---|---|---|---|---|---|---|

|

Male:M Female:F |

Corporate Management | Organizational Management |

Marketing/ Innovation |

DX/ICT |

Financial Accounting/ M&A |

Human Resources/ Human Resource Development |

Risk Management/ Sustainability |

||

| President and Representative Director/ Toru Noda |

M | ● | ● | ● | ● | ● | |||

| Director/ Masateru Kawanishi |

M | ● | ● | ● | ● | ● | |||

| Outside Director/ Yukio Kubota |

M | ● | ● | ● | ● | ||||

| Outside Director/ Kenji Chishiki (independent) |

M | ● | ● | ● | ● | ||||

| Outside Director/ Miki Mitsunari (independent) |

F | ● | ● | ● | |||||

| Director/ Miho Tanaka (independent) |

F | ● | ● | ● | |||||

| Full-time Corporate Auditor/ Masami Nishino |

M | ● | ● | ||||||

| Outside Corporate Auditor/ Hironori Yokote (independent) |

M | ● | ● | ||||||

| Outside Corporate Auditor/ Kanae Fukushima (independent) |

F | ● | |||||||

| Outside Corporate Auditor/ Tsukasa Okamoto |

M | ● | ● | ● | |||||

The reasons for the selection of each item in the skills matrix are as follows.

・Corporate Management

As the business environment surrounding us continues to change, we need the experience and achievements of corporate management in order to make appropriate management decisions and realize sustainable increases in corporate value.

・Organizational Management

In order for approximately 30,000 employees to demonstrate their high level of expertise and teamwork and continue to provide services on a stable manner, we need a high level of organizational management ability and experience.

・Marketing/Innovation

In order to lead the solution of social issues through our business, such as contributing to the declining birthrate and aging population and the optimization of social security expenditures, it is necessary to have a deep understanding of business and the knowledge to create customers and markets with new ideas that are different from the conventional ones.

・DX/ICT

In order to continue to support local communities where people live with peace of mind by integrating “people” and “technology,” it is necessary to have a deep understanding of technology and knowledge to realize advanced and flexible utilization.

・Financial Accounting/M&A

In order to build a solid financial base and realize growth investments (new businesses, M&A) aimed at sustained improvement of corporate value, it requires solid knowledge and experience in the financial and accounting fields.

・Human Resources/Human Resource Development

Our greatest asset is “people,” and in order to promote diversity in which approximately 30,000 employees can thrive in their respective personalities and working styles while maximizing their capabilities, we need a knowledge to formulate a human resource strategy and accomplish it.

・Risk Management/ Sustainability

We are responsible for businesses with a high public profile, thus consider “grow together with society” to be particularly important, and need knowledge to risk management and sustainability in light of laws and compliance.

(8)Compensation of Directors and Corporate Auditors(FY2023)

Policy on Details of Compensation of Directors and Corporate Auditors, etc.

The Nomination, Evaluation, and Compensation Committee is delegated the authority to determine individual compensation and other related matters by the Board of Directors, as it is considered appropriate for the Committee which consists of a majority of Outside Directors, to decide on individual compensation. The Committee made the conclusion on the individual compensation for the fiscal year after deliberations on subjects whether the remuneration is in accordance with the relevant decision-making policy.

The details of the decision-making policy concerning the content of individual remuneration, etc. for Directors are as follows.

a. Basic Policy

The remuneration for the Directors is based on a remuneration system that functions sufficiently as an incentive to continuously improve corporate value, and the basic policy is to determine the remuneration of individual directors in consideration of the level of the Company’s peers, performance, and the balance with the employees.

Remuneration for Directors (excluding Outside Directors) consists of basic remuneration, bonuses, restricted stock remuneration. Basic remuneration consists of director remuneration and business execution remuneration, and is paid monthly. Bonuses are paid for director and execution at certain times in accordance with their roles. The business execution portion of the bonuses consists of fixed and variable remuneration. Variable remuneration is determined by the both qualitative evaluation and a quantitative evaluation linked to the company’s performance (performancelinked remuneration).

Remuneration for Outside Directors is limited to basic remuneration in light of their roles. Basic remuneration consists of director remuneration and committee allowances, and is paid monthly.

b. Policy on performance-linked remuneration, etc.

Performance-linked remuneration uses net sales and operating profit as performance indicators as they are directly linked to the Company’s goal of achieving its 2030 Numerical Goals. The performance goal is to achieve the annual plan for each indicator, and the payment rate of performance-linked remuneration is determined based on the achievement rate. Directors in charge of specific business divisions are designated for indices of their respective divisions in charge, while other directors, including the President, are designated for indices of consolidation.

c. Policy on non-monetary compensation

Restricted stock remuneration provides an incentive to continuously improve corporate value and promotes further value sharing with shareholders. The amount is determined based on performance and their roles. In addition, certain transfer restriction period is to be stipulated by the Board of Directors shall be imposed on the shares to be granted.

d. Policy on determination of details of individual compensation for Directors

In order to supplement the functions of Board of Directors, compensation for each director is determined by the Nomination, Evaluation, and Compensation Committee after deliberation by the Committee. Final decisions on individual compensation can also be made discretionary to the President & Director. If delegated, President & Director must make the final decisions on individual compensation based on the results of deliberations by the Nomination, Evaluation, and Compensation Committee.

The committee is operated with the majority of the Committee being composed of Outside Directors, incorporating the superior aspects of the structure of a company with a Nominating Committee.

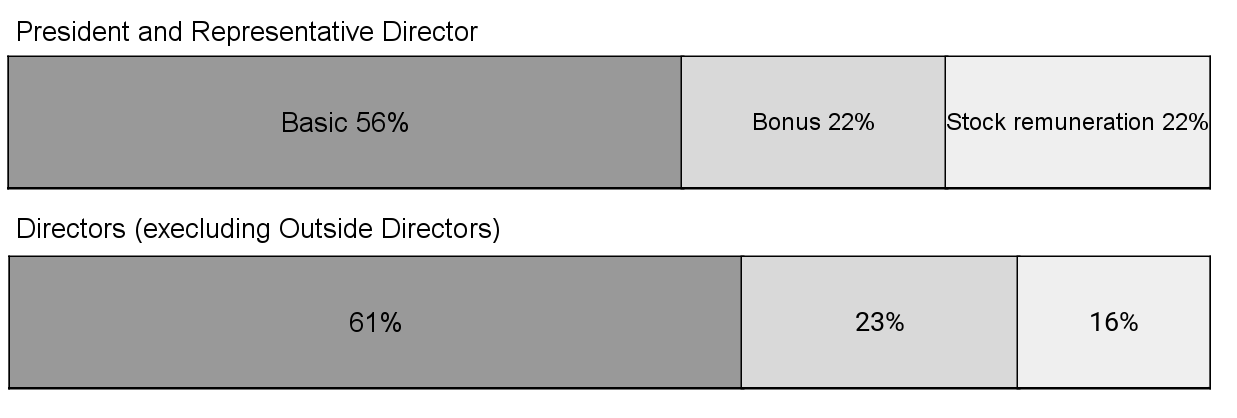

e. Policy on the proportion of remuneration, etc.

The ratio of each Director’s remuneration is determined by the Nomination, Evaluation, and Compensation Committee, with a structure in which the higher the position and the Director in charge of a specific business division, the higher the percentage of the bonus.

The proportion of remuneration for Directors (excluding Outside Directors)

The composition ratio of remuneration for Directors (excluding Outside Directors) for FY2023 is as shown below. Stock remuneration is determined by miltiplying a certain percentage on the basic remuneration and bonus. Bonuses are calculated based on the base of amount thus differs from the composition ratio of actual payments.

| Unit: ¥ in millions | No. of personnel | Total amount | Compensation by types (FY2022) | ||

|---|---|---|---|---|---|

| Basic compensation | Bonus | Non-monetary compensation | |||

| Directors (out of Outside Directors) |

9 (4) |

166 (31) |

122 (31) |

24 (-) |

19 (-) |

| Corporate Auditors (out of Outside Corporate Auditors) |

3 (2) |

29 (14) |

29 (14) |

- (-) |

- (-) |

| Total (out of Outside Directors and Outside Corporate Auditors) |

12 (6) |

196 (46) |

152 (46) |

24 (-) |

19 (-) |

Note. Directors receiving compensation includes the three Outside Directors resigned at the adjournment of the 55th Ordinary General Meeting of Shareholders held on June 27, 2023. The number of paid personnel excludes one uncompensated Outside Director.

(9)Independence Requirements for Outside Officers

In accordance with the independence criteria established by the Tokyo Stock Exchange, we judge outside executives applicable to any of the following as not qualifying as an independent outside officer.

1. A person who is currently a Director (excluding Outside Directors), Corporate Auditor (excluding Outside Corporate Auditor), corporate officer, or employee of the Solasto Group (*1).

2. A person who, during any business year occurring within the past 10 years, is or was a major shareholder (*2) of the Solasto Group, or the director, corporate auditor, corporate officer, or employee of a company for which the Solasto Group is a major shareholder.

3. A person who is or was an executive (*4) of a major Solasto Group business partner (*3).

4. A person who is or was a trustee or other director, corporate auditor, corporate officer, or employee of a corporation or foundation receiving significant donations (*5) from the Solasto Group.

5. Persons dispatched to or from the Solasto Group as a director, corporate auditor, or corporate officer.

6. A person who is or was associated with the Solasto Group’s accounting auditor within the past 5 years.

7. A person who is or was an attorney, Certified Public Accountant, or consultant receiving significant monetary amounts (*6) or other assets from the Solasto Group.

8. A person who is the spouse, blood relative within two degrees, a cohabiting relative, or otherwise engaged in shared living with the following persons :

(1) A Solasto Group business executive

(2) A person who was a Solasto Group business executive during any fiscal year occurring in the past 10 years

(3) Persons deemed not independent based on the above 2 through 7

9. Other persons who, upon a substantive decision by the company, would have potential conflicts of interest with Solasto Group general shareholders if serving as an outside executive.

(Notes)

1: “Solasto Group” refers to Solasto Corporation and its subsidiaries.

2: “Major shareholder” refers to a company, etc. directly or indirectly possessing voting rights equivalent to 20% or more of total voting rights.

3: “Major business partner” refers to a company, etc. whose payments made or received for transactions with the Solasto Group account for 2% or more of the Solasto Group’s or said business partner’s consolidated net sales during any fiscal year during the past three fiscal years.

4: “Executive” refers to a person in the position of executive director, executive officer, or a senior management position of general manager or higher.

5: “Significant donation” refers to donations averaging 10 million yen annually or exceeding 2% of the recipient’s consolidated net sales or gross revenue, whichever is higher, over the past three fiscal years.

6: “Significant monetary amount” refers to amounts averaging 10 million yen annually for an individual, or exceeding 2% of an organization’s consolidated net sales for an organization over the past three fiscal years.

(10)Internal Control System

The Company believes that it is important to establish an effective internal control system in order to enhance the soundness and transparency of its management. The Board of Directors has resolved to establish the necessary systems to ensure the suitability of its operations as the basis for this system.

1)Structure for ensuring work execution by Directors and employees is compliant with law and our Articles of Incorporation

① To fulfill society’s expectations of our company and to clarify our basic stance on corporate ethics and legal compliance, we have outlined the Solasto Group Code of Conduct as basic guidelines for all Group employees. We work to promote the awareness of the code among all executives and employees.

② In accordance with our Compliance Regulations, we established a Risk & Compliance Committee to create and promote a group wide compliance structure.

③ In accordance with our Whistleblowing Regulations, we operate a whistleblowing system to promote the early discovery and correction of any legal, regulatory, or rule violations.

④ We reject all relations with anti-social forces that serve to threaten the order and safety of society. Our entire organization works closely with relevant administrative agencies and attorneys to ensure we respond appropriately.

2)Structure for storing and managing information related to business execution by Directors

① Information concerning business execution by Directors is stored and managed appropriately in accordance with our internal regulations and other document management regulations.

3)Regulations and other structures concerning loss risk management

① In accordance with our Basic Regulations on Risk Management, our Board of Directors works to mitigate and prevent Group risks in order to ensure the survival of the Company and our ability to engage in healthy business operations.

② In accordance with our Basic Regulations on Risk Management, we have established a Risk & Compliance Committee to build and promote a Group risk management structure.

③ The risk management supervisor of each department implements risk management for their respective department. The risk management supervisor makes regular risk management reports to the department in charge of risk management and coordinates on risk management.

4)Structure for ensuring efficient business implementation by Directors

① As the foundation of our structure for ensuring efficient business implementation by Directors, we hold Regular Board of Directors’ meetings once per month and impromptu Board of Directors’ meetings to conduct rapid and accurate decisionmaking on critical matters.

② Details on authority, responsibilities, and procedures related to executions of business decisions made by the Board of Directors are outlined in organization regulations, business allocation regulations, and work authority regulations.

③ In order to clarify the management responsibilities of Directors and enable rapid responses to change in our operating environment, the term of each Director shall be one year.

5)Structure for ensuring proper business practices by the Company, parent company, and subsidiaries that comprise our Group

① We outlined the Solasto Group Code of Conduct and work to build a Group compliance structure to ensure proper business practices by Group companies.

② Departments responsible for the administration of subsidiaries and other affiliates conduct necessary management in accordance with Affiliate Management Regulations including promotion of workflow optimization at subsidiaries.

③ In accordance with Affiliate Management Regulations, subsidiaries provide regular reports on performance and other important matters.

④ In accordance with our Basic Regulations on Risk Management, we appropriately build and operate a risk assessment and management structure for our entire Group.

6)Matters concerning employees when a Corporate Auditor requests an employee assistant, matters concerning independence from Directors, and matters concerning ensuring the efficacy of instructions by corporate auditors to said employee(s)

① The company shall establish a Corporate Auditor department and assign dedicated staff to assist in the work of Corporate Auditors.

② Dedicated staff shall not be subject to instructions or orders from Directors.

③ Personnel reassignments, personnel evaluations, and any disciplinary action of dedicated staff shall be subject to prior approval by the Board of Corporate Auditors.

④ Dedicated staff works to maintain close collaboration with Corporate Auditors by regularly engaging in discussions and exchanging opinions concerning audit results, etc.

7)Structure for Directors and employees to report to Corporate Auditors, structures for other reporting to Corporate Auditors, and other structures for ensuring effective audits by Corporate Auditors

① A Director or employee, or a Director, Corporate Auditor, or employee of a subsidiary, or persons who have received reports from said persons shall report to the Board of Corporate Auditors concerning any incident that has occurred or is at risk of occurring that could cause significant losses to the Company, when it is discovered that an employee or executive has committed a legal violation or fraud, or in the event of other matter deemed requiring reporting by the Board of Corporate Auditors. Notwithstanding the above, a Corporate Auditor may, as necessary, demand a report from a Director or employee, or a Director, Corporate Auditor, or employee of a subsidiary.

② The Company prohibits any unfair treatment of persons making the aforementioned reports to the Board of Corporate Auditors in response to having made such a report. The prohibition of such treatment shall be reinforced among Directors and employees, as well as subsidiary Directors, Corporate Auditors, and employees.

③ Corporate Auditors shall attend Board of Directors’ meetings, management meetings, and any other important conferences and committee meetings necessary to ascertain processes related to important decision-making and business execution. As necessary, Corporate Auditors may request explanations from Directors and employees. Furthermore, Corporate Auditors shall regularly hold meetings with the Representative Director to exchange opinions, promote communication, and ensure the maintenance of an appropriate reporting structure.

④ In accordance with our Whistleblowing Regulations, the Company shall ensure an appropriate structure for reporting legal infractions and other compliance issues to the Corporate Auditors.

⑤ When a Corporate Auditor requests the prepayment or reimbursement of expenses related to their execution of duties, said expenses and liabilities shall be handled immediately excluding when it is deemed that said expenses were not necessary to the execution of duties by said Corporate Auditors.

(11)Actions to Achieve Management with Emphasis on Cost of Capital and Stock Price

Evaluation of the current situation

Our analysis and assessment is that the Company has achieved a return on capital that exceeds its cost of capital. The Company’s return on equity (ROE) is in the top 15% of all TSE PRIME-listed companies, and as market valuation, its PBR (actual) and PER (estimated) are in the top 15% and 30%, respectively, of the market, both above the market median.

Shareholders’ equity cost 7.8%

WACC 6.1%

ROE 18.1%

ROIC 9.8%

PBR (actual) 3.0x

PER (estimated) 14.5x

*Definition: the Company’s shareholders’ equity cost and WACC are as at the March 31, 2023. ROE and ROIC are calculated with the forecasts for FY2022 as of April 3, 2023. PBR (actual), PER (estimated), and the data of TSE PRIME-listed companies used are as of April 3, 2023.

Policy and targets

Since we can analyze and evaluate that the return on equity (ROE) has reached a certain level and the market valuation has also reached a certain level, we do not believe that specific policies and targets for improvement are necessary.

However, the market evaluation of the Company’s stock price has been higher in the past compared to this analysis and evaluation was made. Through the efforts to achieve the goals of the “Medium-Term Management Plan 2025” and the resulting expansion of profit growth potential, we aim to maintain and improve capital profitability over the medium term and enhance the market valuation of our stock.

(12)Dialogues with shareholders

Solasto discloses its Basic Policy on Investor Relations on the company’s website, which was reviewed and approved by the Board of Directors, regarding the development of systems and initiatives to promote constructive dialogue with shareholders.

The status of communication with shareholders (including shareholders and analysts) in FY2023 is as follows.

We conduct dialogues with shareholders and report to the Board of Directors and Corporate Officers their inquiries and comments as their feedback. Shareholder opinions and concerns obtained in the engagemens and feedback are incorporated into our management in a variety of ways.

Main speakers who conducted engagements with shareholders: President and CEO, CFO (Corporate Officer in charge of Investor Relations), General Manager of Investor Relations

Frequency of engagemens:

Financial results briefing conducted quarterly. Direct engagements were conducted for the total of 138 times/companies through one-on-one meetings and small meetings.

Outline of shareholders conducted engagements with:

Fund Managers and analysts, ESG representatives, etc. from active management funds of domestic and overseas institutional investors

Major topics of engagements and matters of interest of shareholders:

Management strategy, environment and strategy for existing and new businesses, environment and status of M&A, and PMI status after M&A.